STOP AN EXCESSIVE FEDERAL TAX ON SAFER NICOTINE PRODUCTS

The House Ways & Means Committee has revealed that it is considering a tax proposal on nicotine and tobacco as part of the funding bill for President Biden’s “Build Back Better” plan. The provision is designed to equalize taxation across all tobacco and nicotine products.

In other words, the tax on demonstrably less harmful products like vaping, snus, and smokeless tobacco would be the same as the tax on cigarettes – the most harmful tobacco product.

In addition to taxing all nicotine and tobacco products as if they were a cigarette, the provision increases the Federal tax on cigarettes by 100%, and raises all other tobacco taxes up to this new level.

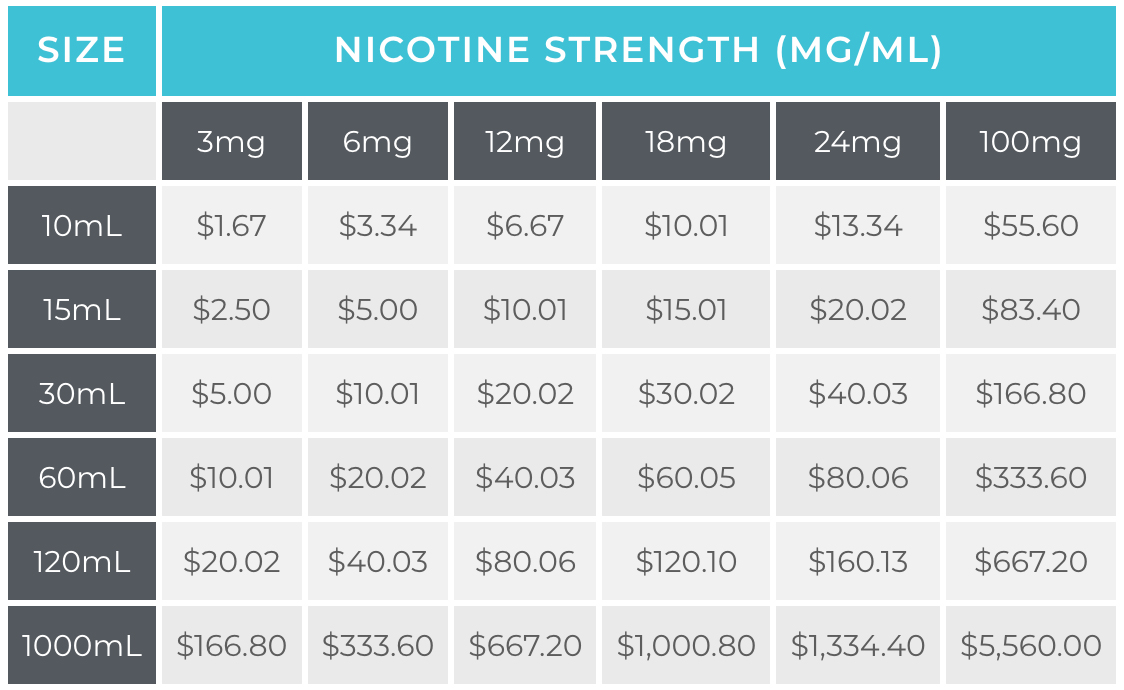

What does this increase look like for safer nicotine and tobacco products?

- Nicotine used in vapor products (synthetic, TFN, and tobacco-derived)

- $100.66 per 1,810mg of nicotine ( $0.05/mg)

- To put this in more relatable terms (see the table below), this new tax would add $10.00 to a 30mL bottle of 6mg e-liquid. This is in addition to any state or local taxes people may already be paying.

- The tax on smokeless tobacco will be raised from $1.51 per pound ($0.09/oz) to $26.84 per pound ($1.68/oz).

- A new tax on “discrete single-use units” (pouches) will be imposed at the rate of $100 per 1000 units ($0.10 per pouch, which adds $1.50 – $2.50 to a tin).

- Under this proposal, the tax on one JUUL pod would actually be higher than the tax on a pack of cigarettes!

The Ways & Means Committee is still hashing out the details of the larger tax proposal, so now is the time to start contacting your federal officials and urge them to reject this dangerous tax.

CLICK HERE to TAKE ACTION against this NEWLY PROPOSED FEDERAL TAX.

Thank you.

.

Share: